Fun & effective CPA practice test tool to pass with flying colors

All-in-one platform with everything you need to ace the CPA on your first attempt

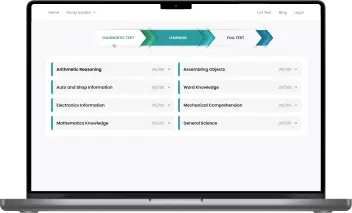

Clear and Thorough Learning Path

Proven CPA 3-step Practice Formula

After our 100,000+ users' success stories, we developed a 3-step strategy to provide you with the most precise and in-depth learning path while minimizing your prep time.CPA Diagnostic Test

First, take this short test and get your detailed report showing your strong and weak areas. Save your time by concentrating on what is in demand.Learning

With quick, bite-sized learning techniques and a detailed study guide for each CPA section, you can really strengthen your weaknesses (from step 1) and boost your scores.CPA Full Test

The last step for your preparation is taking our full CPA practice tests and seeing how far you've come since the beginning. Repeat the 3-step formula until you are satisfied with your results!Ready to start?

Thousands of CPA users already accomplished their goals.NOW it’s your turn!

What You Get

All-in-one platform

A complete CPA Prep Platform, including a diagnostic test, detailed study guides for all topics, practice questions with step-by-step explanations, and various full simulator tests.

Questions nearly identical to those in the real CPA test

All questions are categorized into the specific sections as on the real CPA: Same format & same difficulty!

Best for the busy

Easily & quickly grasp all the knowledge with our unique learning technique. And you can learn anytime, anywhere on any devices, even with a few free minutes.

Practice while having fun

Learn and play! Complete round-by-round to reach your daily achievement and make progress on your learning journey!Featured on

What our users are saying

Over 50,000 aspiring American candidates use CPA monthlyTo get licensed to practice accounting in a given state, one must first take and then pass the Certified Public Accountant exam. The majority of applicants often satisfy the criteria for education, experience, and residence, even though each state and jurisdiction creates its own qualifying rules. The Certified Public Accountant (CPA) exam is designed to test candidates' knowledge and abilities in various areas of accounting procedures and ideas.

This article will explain what the Certified Public Accountant (CPA) exam is, what topics it covers, how boards grade it, how to study for it, and provide you with some recommendations to help you do well on the exam.

What is the CPA?

Aspiring accountants must take and pass all four sections of the Uniform Certified Public Accountant (CPA) examination to be eligible to apply for CPA licenses in their respective states. Examining for the CPA designation is a prerequisite for obtaining a professional license and may be done via the Association of International Certified Professional Accountants (AICPA). There are 55 different accounting jurisdictions spread throughout the 50 states, and the boards of accountancy in each state are responsible for determining their own educational and professional experience prerequisites for licensing.

The exam evaluates the knowledge and abilities of accountants to function as entry-level professionals in a variety of accounting specializations. Aspiring certified public accountants (CPAs) may be required to take and pass an ethical exam in many of the 55 countries. Before applying to take the exam, it is essential to do research on the criteria for licensing in your state. The educational and professional experience requirements that are necessary to get a license might vary from one jurisdiction to another.

CPA Exam Content Outline

The AICPA is charged with maintaining and updating each of the exam components so that they are current and represent the most applicable practices. The subjects that are tested on the CPA exam continue to be shaped by developments in accounting and finance technology. This necessitates the constant modification of exam content in the form of additions and deletions to provide the most applicable evaluation resources for candidates for the CPA exam.

The CPA exam comprises a total of 276 multiple-choice questions, 28 task-based simulations, and 3 writing parts. Think about 4 different parts of the exam and what each one covers:

Auditing and Attestation (AUD)

This segment of the exam tests your knowledge and abilities in commercial transactions and procedures, and it also introduces you to new subjects in technology applications. In this part of the CPA exam, you will also be tested on your knowledge of IT controls and systems for accounting and corporate data. In addition, the AUD component of the exam consists of 72 multiple-choice questions and between 8-9 task-based simulations. The questions and simulations cover the following areas of study:

- Ethics, professional responsibilities, and general principles

- Performing risk analysis and developing a response plan

- Continuation of the processes and obtaining evidence

- Developing judgments and submitting reports

- Data accuracy and completeness for auditing evidence

- Analytical tools and data for auditing

- SOC 1 and SOC 2 reporting, controls, and control testing

Business Environment and Concepts (BEC)

The BEC portion of the test consists of 62 multiple-choice questions along with between 4-5 simulations depending on the tasks. Additionally, there are three written answer questions in this area. Along the same lines as the revisions made to the AUD section, the BEC has been updated to include a variety of fundamental ideas that test the knowledge and abilities of accountants. These fundamental ideas include the governance and implementation of internal accounting controls. In addition to this subject matter, the BEC examines applicants' knowledge of a variety of other fundamental ideas, such as the following:

- Governance of corporations

- Governance of accounting controls and system design

- Concepts and evaluations of the economy

- Financial management

- Management of information technology and operational processes

- Management of risks and controls at the transaction level

- Governance of data and data extraction

- SOC 1 reporting, including complementary user controls

Financial Accounting and Reporting (FAR)

The financial reporting section has also been updated with new questions focusing on pension plans and derivative journal entries, as well as the removal of content that related to the International Financial Reporting Standards (IFRS) and the United States Generally Accepted Accounting Principles (U.S. GAAP). The amount of questions has not changed; there are still 66 multiple-choice questions and between 8-9 items based on a task simulation. The following essential subjects will be discussed in this section:

- Conceptual framework, standard-setting, and financial reporting

- Select financial statement accounts

- Select transactions

- State and local governments

Regulation (REG)

The REG part has a total of 76 questions with multiple-choice answers and between 8-9 simulations dependent on completing tasks. A number of recent adjustments have also been made to the regulatory section. One of them is the elimination of exam questions that were related to trusts, estate taxation, and alternative minimum taxes. The REG section discusses a number of important subjects, including the following:

- Ethical considerations and professional obligations

- Business legislation and law

- Transactions subject to federal taxes on property

- Individual federal taxation, including preparation and strategies for planning

- Entity federal taxation, including preparation and strategies for planning

CPA test-takers have 16 hours to finish the exam, with each component allotting them a time limit of four hours. Candidates are given the freedom to choose the sequence in which they want to tackle each particular component of the examination. It is required for candidates to pass all 4 portions of CPA in 18 months. Different jurisdictions have different beginnings of the 18-month time frame.

CPA Exam Scoring

The American Institute of Certified Public Accountants (AICPA) is the organization that is responsible for developing and scoring the exam, using a scale that ranges from zero to 99 for each section. To pass each part, you need to get a score of at least 75. Your final score is determined by a weighted mix of the scaled scores you received from the multiple-choice questions and the task-based simulations you completed for the AUD, FAR, and REG sections. Questions with multiple choice account for fifty percent of the final score, while simulations with different tasks count for the other fifty percent.

Your final score for the BEC portion is determined by adding together your scaled scores from the task-based simulations, multiple-choice questions, and written communication activities. These values are then weighted differently. Questions with multiple choice provide for fifty percent of the overall score, task-based simulations account for thirty-five percent, and written communication activities account for fifteen percent.

The multiple-choice questions that appear in the exam sections are presented in the form of multi-stage tests. The first mini-test is often considered to be of average difficulty. Your performance will determine whether the subsequent test will be on the same level of difficulty as the previous one, or somewhat more challenging.

Is the CPA Exam Curved?

There is a lot of misunderstanding over whether the CPA Exam is evaluated on a curve, which would suggest that the final grade would be determined by comparing the scores of all test-takers rather than the individual's actual performance.

The CPA Exam is not graded on a curve, according to the AICPA, but that doesn't mean it runs in the same way as a typical exam. As you surely know, each component of the test is rated on a scale that varies from 0 to 99, and to succeed in a portion, the applicant must achieve a minimum of 75.

Within each test, 3 tests differ in complexity. Each individual will start with a test of medium level, and their performance will decide whether the next test they get is more difficult - basically bending the exam depending on the individual’s performance, but still scoring the test separately from other examinees.

CPA Exam Question Types

The AICPA utilizes a wide range of question types to test its material. Before you take the CPA exam, you will need to have previous experience with each of the different types of questions that will be on the exam.

Multiple-choice questions (MCQs)

Multiple-choice questions on the CPA Exam consist of a central question and four possible responses to that question. There are three possible answers that are considered to be distractors. These are challenging because they are founded on widespread misunderstandings or mistakes in reasoning. The best way to respond to the underlying question will be to provide an accurate answer.

Task-Based Simulations (TBSs)

The majority of the work that an accountant does may be modeled via the use of task-based simulations. The preparation of diary entries, the editing of memoranda or emails, the investigation of rules and legislation, and the collection of data from a variety of sources are examples of these tasks. In many TBSs, you will be required to make use of a variety of displays that are made available to you inside the simulation in order to gather the data that is necessary to do a certain assignment.

Written Communications (WCs)

Writing a response to a scenario in the form of a business note that addresses the requirements and concerns of the designated party in the same way as a CPA working in the field would be required to finish a written communication. A mark will be given for each of these activities based not just on the substance and legality of your response, but also on your writing abilities.

At first look, the WCs may seem to be scary; yet, successful applicants say that the questions themselves are not very difficult to respond to. The most important thing is to keep track of the time you have on the exam and to make sure you have enough of it when you come to the test.

Because the WC questions are only on the last test of the BEC, you will need to be sure that your time management allows for the additional time that these questions may demand.

How Each Question Type is Tested?

Every part of the CPA Exam consists of both task-based simulations and multiple-choice questions. However, the Written Communications component is exclusive to the BEC part. The following is a breakdown of the different question types that will be on the CPA Exam for each session.

|

Question Types on the CPA Exam |

||||

|

Section |

AUD |

BEC |

FAR |

REG |

|

Testlet 1 |

36 MCQs |

31 MCQs |

33 MCQs |

38 MCQs |

|

Testlet 2 |

3 MCQs |

31 MCQs |

33 MCQs |

38 MCQs |

|

Testlet 3 |

2 TBSs |

2 TBSs |

2 TBSs |

2 TBSs |

|

Testlet 4 |

3 TBSs |

2 TBSs |

3 TBSs |

3 TBSs |

|

Testlet 5 |

3 TBSs |

3 WCs |

3 TBSs |

3 TBSs |

|

Total MCQs |

72 |

62 |

66 |

76 |

|

Total TBSs |

8 |

4 |

8 |

8 |

|

Total WCs |

0 |

3 |

0 |

0 |

What Makes The CPA Exam Difficult?

Certified Public Accountant Examination (CPA Exam) is often considered to be one of the most challenging expert exams; surprisingly, it rates higher on the difficulty scale. All of our friends and family members who are not accountants may find this to be incomprehensible, but those of us who are now CPAs or who are studying to become CPAs are well aware of how taxing the exam can be. Consequently, this leads one to wonder why the Test is so challenging.

Several aspects contribute to the CPA exam's reputation as one of the most difficult tests for obtaining a certificate. The huge quantity of material that is going to be tested has been cited as the main cause of the test's difficulty by the great majority of test takers, which in turn necessitates a significant amount of time spent studying and getting ready for the exam. Each segment has several different kinds of questions, you have a limited amount of time to complete it, and it has many levels of difficulty.

Question Types

One of the exam's parts uses a variety of question formats, in contrast to the other three portions, which solely use multiple-choice questions. The exam is divided into four components. There will also be simulations based on a certain task or circumstance, as well as simulations of written communication. Some of the questions will be multiple-choice, but there will also be other types of questions. The questions with several choices are challenging.

In many cases, there is more than one right answer; nonetheless, you are charged with picking the answer that is the best out of the options that are offered. Questions involving task-based simulations and textual communication are separated into their sections of the examination, which are referred to as "tests."

Time Limitations

The time restriction for each of the four parts is four hours, which means that in order to pass the CPA, you will need to have completed a total of at least 16 hours of examinations. You will be granted an 18-month window beginning on the day that you pass the first portion of the exam during which you will be allowed to take the following three sections of the exam in any order that you want. This window will begin when you pass the first component of the exam.

A good number of candidates decide to start with the exam that they believe to be the toughest, and then go on to the others. There is a significant registration fee involved, and that fee must be paid again if any part of the exam taken is failed.

The FAR, the AUD, and the REG tests are often performed first, followed by the BEC exam as a capstone to the testing procedure. Because of this, it will be possible to have a path that is more natural and builds on information previously obtained.

What is the Hardest Part Of The CPA Exam?

As previously mentioned, the Certified Public Accountant exam is composed of four sections that are further subdivided into many subtests. These portions evaluate your understanding of Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Auditing and Reporting (FAR), and Regulation (REG). The majority of students enrolled in the CPA program have said that the FAR component was the most challenging.

The data do not lie; the FAR is without a doubt the most challenging part of the CPA test. The section had a pass rate of slightly over 46% for the first quarter of 2020. When this data is contrasted with the Q1 pass rate for BEC, which was a respectable 61%, it becomes very evident that individuals had a more difficult time passing the FAR.

The cost is, of course, the last consideration to take into account. You need to pay for and have an NTS issued for each segment, and the delivery time for these may range anywhere from several weeks to many months. If you fail a section, you have to wait until you have another NTS before you may retry it. The budget and the schedule may frequently be a significant barrier in the way of completing the task within the allotted period of 18 months.

How to Prepare for the CPA Exam?

You may use these steps to ensure your exam spot and prepare for upcoming exams:

Register for the CPA exam

There are two methods to apply, but the one you must use depends on your state. The National Association of State Boards of Accountancy's online application process is used by the majority of states. However, some jurisdictions demand that you apply for the exam directly by contacting your State Board of Accountancy. It is crucial to know which phase of the exam you are taking so that you may apply the appropriate exam subtest since each exam segment is administered individually.

Plan your test in advance

When you get a notification to arrange an exam, book it right away to choose the most convenient test dates and hours. If you need to adjust your test date, think about scheduling it early in the testing window, which gives you greater flexibility to reschedule within the same timeframe. Your notice is generally good for half of a year. However, this time frame may change based on the laws in your jurisdiction.

Examine the CPA exam specifications

The substance of each of the 4 subtests is thoroughly outlined in the exam specifications for the CPA exam. The AICPA resource site offers comprehensive exam blueprints that show the abilities required for each examination topic. As a result, studying the exam blueprint is crucial to know what to anticipate on test day. The blueprints may also provide you with more details on the subjects, accounting rules, and techniques you should pay attention to when learning.

Utilize practice exams online

Online practice examinations are available on the NASBA and AICPA websites to aid with your preparation. You may acquaint yourself with the structure and length of time required to finish different exam items by taking the four sample exams that replicate each of the 4 regions. The sample examinations might take a few hours to finish, so you can learn how to effectively manage your time.

CPA Practice Test features

Free Practice Questions: 1000+ FREE CPA practice questions with detailed explanations are available for all of the required skills. All you need to pass your recruitment test is available here.

CPA Practice Tests Based On Real Tests: Same number of questions, same time limits, same structure. The exam simulators let you familiarize yourself with the test format and get totally ready for the real one.

No Sign-Up Or Login Required: All of your progress is saved without an account, even if you close your browser. But login can sync your data between web and mobile applications.

Gamification: The learning process will be divided into small milestones. Let’s make your studying exciting as if you were in some interesting games.

Personal Study Plan: Just enter your CPA test date, and a study plan will be set up for you. A clear schedule will surely exceed your expectation and get you the best preparation for the reading shot.

3 Interesting Test Modes: 3 different test modes with increased difficulty levels let you experience the test in various ways.

Dark Mode: Experience a dark theme that is more friendly to your eyes, and get a whole new and marvelous experience.

No Internet Required: Study on the go conveniently without any Internet connection.

CPA Test Bank: 3 features: Weak/ Medium/ Strong questions help you clearly determine which area you should pay more attention.

FAQs About the CPA Exam

How many CPA candidates pass on the first try?

You've probably heard quite a few alarming details about how challenging it is, such as the fact that it's lengthy, it requires several hundred hours of studying, and it's so challenging that the average passing rate for first-time applicants on the CPA Exam is only 50%. You've probably also heard these details.

Which portion is the easiest for CPAs?

In any case, the Business Environment and Concepts section of the Certified Public Accountant test is regarded as the most straightforward since it has the highest pass rate. According to the AICPA, one of the reasons why BEC is higher is because it is the component that is most usually taken last. As a result, students have greater experience with taking tests after they have completed previous sections.

What is the lowest score on the CPA exam?

To pass a part of the CPA Exam, you need a score of at least 75. Have you ever been curious about the formula that the AICPA uses to determine your section scores on the CPA Exam? Scores are reported on a scale that ranges from 0 to 99.

What does it indicate when the CPA score is 74?

It is not true that you were only one point away from passing the CPA Exam with a score of 74. Instead, your score of 74 indicates that after they established that you did not pass, they compared your performance to that of other individuals who did not pass and found that you performed better than they did but did not pass.

What happens if I fail one section of the CPA Exam?

You are required to wait until the following testing window to retake a portion of the CPA Exam if you did not pass that section the first time around. Each year, there are four different times available for testing. The testing window extends throughout the first two months of each quarter in addition to the first ten days of the third month of each quarter.

How many times can I take the CPA Exam?

You are permitted to repeat the CPA Exam an unlimited number of times; however, you are only allowed to take each portion of the exam once during each testing session. Concentrate on improving in the areas in which you performed poorly and consider modifying your study habits to get better results.

What is the hardest CPA question type?

The majority of applicants find the task-based simulations to be the most challenging component of the examination. Candidates need to analyze information obtained from a variety of sources and carry out a variety of actions utilizing that knowledge to successfully answer these questions. In addition, the fact that they come after both of the MCQ testlets indicates that you are already far into your exam period and that mental weariness may have already started to set in for you.

How much time does it take to acquire the results of the CPA?

It is recommended that scores be posted no later than forty-eight hours after the CPA release dates. There is a possibility that scores will be posted on the NASBA website the day before the date that was originally planned for their publication. On the other hand, some states may need an additional day to process and disseminate test results.

What are the consequences if I don't pass the CPA Exam within 18 months?

You will not receive credit for the first part that you passed, and the 18-month window will roll up to the next part that you passed; this cycle will continue until all four parts are passed within the time frame. If you do not pass all four parts within the time frame, you will lose credit for the first part that you passed.

Who may look at my score on the CPA exam?

Your employer, including your present boss and any employers you may have in the future, are not permitted to request to examine your results. They will not be able to see the results of your examination, regardless of whether they write to NASBA, the AICPA, or your state board.

The AICPA considers the following skills to be the most valuable in an advanced CPA candidate: absolutely brilliant time- and project-management skills, a complete overview of financial reporting, and the capacity to communicate and then use experiences and knowledge. Acknowledging the difficulty enables you to plan methods for overcoming the obstacles and provides you with a perspective on these skills.

We are here to assist you. Learn more about our article, and get started right now on the path that will lead you to pass the CPA Exam.