Fun & effective CFA Level 1 practice test tool to pass with flying colors

All-in-one platform with everything you need to ace the CFA Level 1 on your first attempt

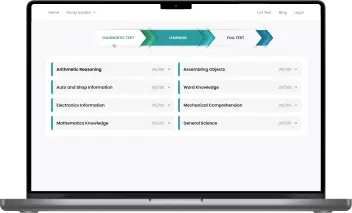

Clear and Thorough Learning Path

Proven CFA 3-step Practice Formula

After our 100,000+ users' success stories, we developed a 3-step strategy to provide you with the most precise and in-depth learning path while minimizing your prep time.CFA Level 1 Diagnostic Test

First, take this short test and get your detailed report showing your strong and weak areas. Save your time by concentrating on what is in demand.Learning

With quick, bite-sized learning techniques and a detailed study guide for each CFA Level 1 section, you can really strengthen your weaknesses (from step 1) and boost your scores.CFA Level 1 Full Test

The last step for your preparation is taking our full CFA Level 1 practice tests and seeing how far you've come since the beginning. Repeat the 3-step formula until you are satisfied with your results!Ready to start?

Thousands of CFA Level 1 users already accomplished their goals.NOW it’s your turn!

What You Get

All-in-one platform

A complete CFA Level 1 Prep Platform, including a diagnostic test, detailed study guides for all topics, practice questions with step-by-step explanations, and various full simulator tests.

Questions nearly identical to those in the real CFA Level 1 test

All questions are categorized into the specific sections as on the real CFA Level 1: Same format & same difficulty!

Best for the busy

Easily & quickly grasp all the knowledge with our unique learning technique. And you can learn anytime, anywhere on any devices, even with a few free minutes.

Practice while having fun

Learn and play! Complete round-by-round to reach your daily achievement and make progress on your learning journey!Featured on

What our users are saying

Over 50,000 aspiring American candidates use CFA Level 1 monthlyFree CFA Level 1 Practice Questions 2024

What is the CFA Level 1 exam structure?

Number of questions: 180 multiple-choice questions

CFA exam format:

The first session (2 hours, 15 minutes): 90 multiple choice questions, covering the topics of ethics & professional standards, quantitative methods, economics, and financial reporting and analysis

Second session (2 hours, 15 minutes): 90 multiple choice questions, covering the topics of corporate finance, equity, fixed income, derivatives, alternative investments and portfolio management

Time limit: split between two 135-minute sessions (session times are approximate). There is an optional break between sessions. Candidates must take both sessions to receive an exam result.

What is on the CFA Exam?

- Ethical and Professional Standards

- Quantitative Methods

- Economics

- Financial and Reporting Analysis

- Corporate Finance

- Equity Investments

- Fixed Income

- Derivative Investments

- Alternative Investments

- Portfolio Management

Ethics and Professional Standards

This is one of the most important parts of CFA to the promotion of universal professional ethics. The subject covers the code of ethics, professional standards, and Global Investment Professional Standards (GIPS) as a larger part of the ethics aspect as applicable to the financial industry.

Corporate Finance

This subject is rather limited in its scope with 7% weightage and covers areas related to capital budgeting, NPV IRR, cost of capital, measures of leverage, basics of dividends, and share buybacks along with working capital management and corporate governance of listed companies. Some of the issues addressed consist of agency problems in the context of the agency-principal relationship.

Economics

This subject covers the fundamentals of micro as well as macroeconomics with its primary concentrate on the latter. This section has 10% weightage which makes it essential enough to be pursued with diligence.

Financial Reporting and Analysis

The section has nearly 20% weightage, making it an important enough knowledge area for anyone pursuing CFA. This part tests the knowledge of financial ratios and financial statements commonly employed for the target of financial analysis. Along with, one should be well-conversant in the concepts of revenue recognition, accounts receivables, and inventory analysis along with taxes and long-term assets. It should be kept in mind when preparing for this exam that local accounting practices do not hold much relevance as CFA is more of a global exam and concentrates on US GAAP and IFRS practices.

Quantitative Methods

This part is focused on quantitative analysis and mathematically-oriented approaches to address complex financial problems that make this knowledge area of such great value. Some sections in this part consist of performance measurement, time value of money, statistics and probability basics, sampling, and hypothesis testing along with correlation and linear regression analysis in excel. A study of these concepts brings highly useful tools and techniques for the knowledge areas of fixed income, equities, and portfolio management. A suitable understanding and grasp of quantitative techniques would be helpful in mastering a good proportion of CFA’s body of knowledge.

Alternative Investments

This subject contains forms of investment not covered under other knowledge areas of CFA. This consists of real estate funds, venture capital, hedge funds, and commodities. In addition, a special focus on commodities so it helps participants have an in-depth awareness of concepts related to trading in commodities. There could be 7 or 8 conceptually oriented questions, some of them related to commodities. Though this part is short on weightage in CFA Level I, with proper effort, these sections could be mastered with comparative ease.

Derivatives

Derivatives are complex financial instruments, and this part deals with them particularly, containing the basic futures, forwards, options, swaps, and hedging techniques usually employed. More complex mathematical ways are usually employed for studying these exotic financial instruments. On Level I, most of the material is still introductory, and the weightage of this section is only 5%, with only about 12 questions in the exam from this section.

Equity Investments

This section first deals with equity markets and covers various tools and techniques available for the valuation of companies - DCF, PE Ratio, PBV, PCF… This subject has about 10% weightage with about 25 questions. Most of the questions related to the valuation and analysis of companies.

Fixed Income

This part covers fixed income markets and instruments and their pricing techniques. Important concepts, containing yield measures, duration, and convexity, are discussed. This section sequentially deals with the bond analysis and valuation before taking up the bond’s features before finally moving on to 10 risks related to debt investments. The exam weightage is 10%.

Portfolio Management

This part solves basic principles of portfolio management and introduces some key concepts containing the Theory of Modern Portfolio and Capital Asset Pricing Model. Section weightage is only 7% - 17 questions in the exam. But this part gains increasing significance in Level II and Level III of CFA as the focus shifts to the application of available knowledge for efficient portfolio management.

Tips and tricks

- Do NOT ignore Ethics, thinking that it is one of those questions that don’t require much reading. Only discovered your mistake during the practice exam period (1-2 months before exam date) and scrambled to cover that topic. However, Ethics isn’t intuitive and you have to learn it sometimes.

- Study from other test takers - Always good to check out the common patterns in past exams.

- Master your calculator - whether it is BA II Plus or HP12C, ensure by the time exam time comes you’re comfortable, fast yet accurate with it. It’s worth checking out the BA II Plus and HP12C calculator tips to make sure you don’t miss anything out. Also, clear your work before you begin a new calculation for a question.

- Practice - Given the multiple-choice nature of Level 1, the more questions you can try the better to maximize studying. It is best to permit at least 1 month before exams to focus on this, as you will always discover new parts that you need more work on.

- Exam time management is key – Level 1 is about the breadth and you have to be ruthless in time management (1.5 minute max / multiple-choice question), before you fall into this slippery slope and not be able to recover ground. Give yourself to mull over questions, but once times up, select an answer and move on! There are no penalties for incorrect answers, therefore guessing is better than leaving it blank.

- Take care of yourself - Take care of your well-being by gaining some balance between study, play, and sleep.

CFA Exam FAQs

What is CFA Level 1 Expected salary?

The total exam fees for CFA Level 1 are US$1,150-$1,450, including training

A one-off enrolment fee of US$ 450, plus

Exam registration fee of US$700-1,000 depending on how early you register.

How to Study for the CFA Level I Exam

- Manage your time: CFA exams need a serious time commitment. To aim for consecutive passes in a short time, at least 300 study hours over a 6 month period is recommended. This means a minimum of 11.5 hours of study over a 7 day week.

- Create a customized CFA study plan: Depending on work/life commitments (here’s a few CFA Fast Track study plans as reference for different profiles), create a study plan that works for you.

- Reserve the last 4-8 weeks for practice exams & revision: Ensure you have covered the study material beforehand to have a proper go at the practice papers. 5 months before - spent this whole month just skimming through everything to get a feel of the materials.

- 3-4 months before - Reread the materials in detail and tried out the End of Chapter questions, noting down parts that you cannot understand fully or frequently got wrong.

- 2 months before - for question practice and last-minute material studies on areas that you needed more work on.

- Last month - the week or two before exams to fully focus on nailing the rest of your practice exams and rereading materials on areas you have noted you are weak in.

Should I Take the CFA Exam?

Yes, CFA Exam help:

- Enhances Your Finance Career Path

- Equips You With Graduate Level Knowledge in Finance.

- It’s Affordable and a Good Return on Investment.

- It Helps You Get A Job.

- CFA Commands Higher Salary and Compensation Package, On Aggregate.

Does CFA Level 1 expire?

It doesn't have an expiry date.

It said that you have cleared your level 1 exam and are one step closer to achieving your CFA charter. It's not a level-based degree as well.