This article shall describe the topics included in CFA Level 1 subjects. You will also learn about CFA level 1 exam weights as well as the quantity of formulas and texts that must be studied. The level 1 computer-based test’s question count has also been reduced from 240 to 180, yielding 90 questions per exam session. We will estimate the amount of exam questions per topic for Level 1 exams in the summary below.

Take advantage of our free CFA Level 1 practice test to ensure acing the real test the first time.

CFA level 1 topics are focused on learning fundamental financial concepts. It is critical to comprehend the subject-wise organization of the exam. There are 10 subjects of CFA Level 1 exam divided into four modules, each of which increases in difficulty from CFA Part I through Part II and III. The four knowledge modules of the CFA exam consist of investment tools, ethics and professional standards, asset classes, portfolio management, and wealth planning.

The exam consists of the following 10 topic areas:

- Ethical and Professional Standards

- Quantitative Methods

- Economics

- Financial and Reporting Analysis*

- Corporate Finance*

- Equity Investments

- Fixed Income

- Derivative Investments

- Alternative Investments

- Portfolio Management

*Note: Two subjects in your 2022 CFA exam curriculum will have new names. FRA (Financial Reporting and Analysis) becomes Financial Statement Analysis, and Corporate Finance becomes Corporate Issuers. However, the subjects are similar in content. We’re still using the well-known old names because the change is quite recent.

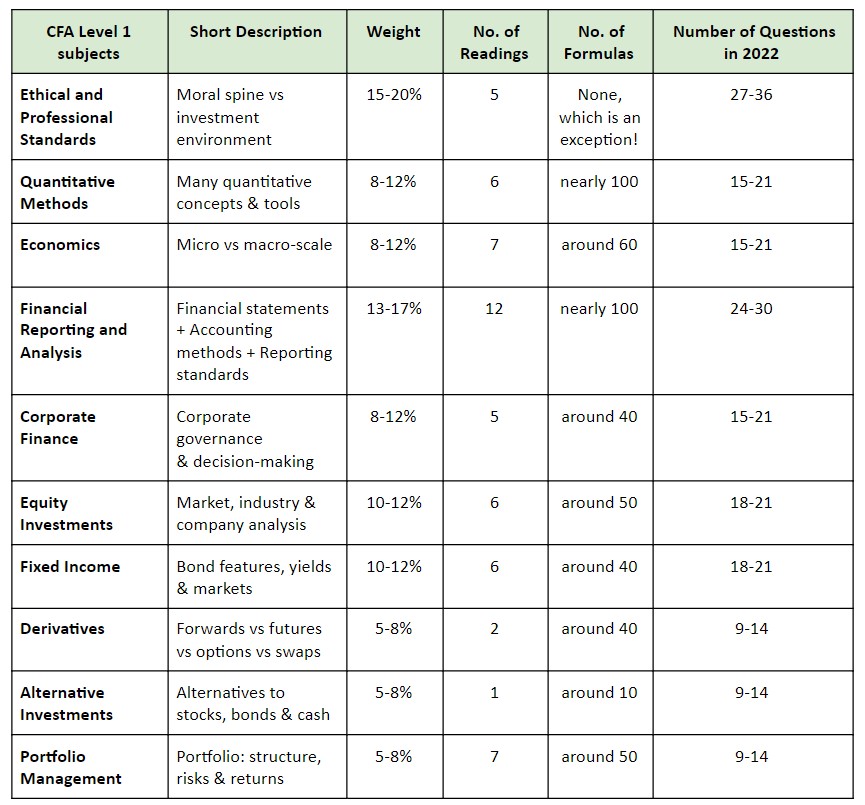

This is how your curriculum’s subjects are organized. If you learn more about the topics, you’ll probably want to change the order. We present what we consider to be the best level 1 subject sequence at the conclusion of this post. Furthermore, all of the important information concerning the ten subjects is organized in a table to enable easy analysis.

We have put up a table that shows the knowledge areas and their specific weightage of CFA Level 1 subjects.

1. Ethics and Professional Standards

The CFA level 1 ethics covers the code of ethics, professional standards, and Global Investment Professional Standards (GIPS) as a major part of the ethics aspect related to the financial industry. Because the CFA certification program is dedicated to developing universal professional ethics, it is one of the most important areas of study. Ethics is one area that receives relative weightage in all three CFA Levels, as seen by subject weightage.

Your goal: Being a moral person is beneficial, but it is insufficient! You must learn to analyze investing situations and identify ethical problems.

Key terms: integrity, responsibilities towards clients and the employer, loyalty, prudence, due care, mosaic theory, diligence, Investment Policy Statement, Global Investment Performance Standards (GIPSes)

2. Quantitative Methods

This topic focuses on quantitative analysis and mathematically-oriented methods to deal with complicated financial issues, making this subject area extremely valuable. Some of the most crucial areas covered in this section include performance measurement, time value of money, statistics and probability basics, sampling, and hypothesis testing, as well as correlation and linear regression analysis in excel.

A thorough understanding of these concepts will give you essential tools and approaches for learning about fixed income, equities, and portfolio management. Furthermore, a thorough understanding and grasp of quantitative approaches would assist in the mastery of a significant portion of the CFA’s body of knowledge.

Your goal: You will want to make sure you’re familiar with quantitative concepts and tools, as well as how to use them. They will come in handy again shortly when you’re learning PM and CF.

Key terms: time value of money, measures of location & dispersion, interest rate, normal distribution, random variable, sample, confidence interval, hypothesis testing, Student’s t-distribution

3. Economics

The fundamentals of microeconomics and macroeconomics are covered in this section, with a primary on the latter. Those having an economics background typically perform well with macroeconomics, making it easier to assimilate all of the information offered through graphical presentations, which is the normal method. However, because this subject has a 10% weight, it is critical to study it thoroughly.

Your goal: Learn about how economies work on a micro and macro scale. There are a lot of definitions to deal with.

Key terms: consumer surplus, equilibrium, normal goods, profit maximization, perfect competition, inflation, unemployment, exchange rate, fiscal policy, central bank, GDP, IS-LM, BOP, Monetarism vs Keynesianism

4. Financial and Reporting Analysis

This exam assesses your understanding of common financial statements and financial statements used in financial analysis. It has roughly 20% weightage, as we’ve already stated, making it a significant enough knowledge area for anyone pursuing CFA. In addition, one should be familiar with the principles of revenue recognition, accounts receivables, inventory analysis, taxes, and long-term assets.

While studying for this exam, keep in mind that local accounting methods are of little importance because the CFA is a worldwide exam that focuses on US GAAP and IFRS.

Your goal: Learn about different accounting methods, financial statements, and reporting standards.

Key terms: total comprehensive income, operating & finance lease, accrual basis, depreciation, carrying amount, goodwill, bonds payable, income tax, indirect method, DuPont analysis, U.S. GAAP, IFRS, LIFO, EPS, FIFO

5. Corporate Finance

With only 7% weightage, the scope of this section is quite limited. It covers capital budgeting, cost of capital, NPV IRR, measures of leverage, basics of dividends, and share buybacks, as well as working capital management and corporate governance of listed companies. Agency issues in the agency-principal relationship are among the issues addressed.

Your goal: Learn how and why a corporate make decisions concerning financial leverage, investment projects, dividends, and others.

Key terms: pure-play method, breakeven point, DOL, DFL, DTL, ex-dividend date, inventory, accounts receivable, accounts payable, operating cycle, board of directors, NPV, IRR, WACC, trade credit

6. Equity Investments

This section focuses on equity markets and includes numerous methods and approaches for valuing corporations, such as DCF, PE Ratio, PBV, PCF, etc. With roughly 25 questions in the exam section, this component is nearly 10% weightage. The majority of the questions might be on business valuation and analysis.

Your goal: Learn about the market organization, indices, and efficiency as well as the basics of industry & company analysis.

Key terms: leveraged positions, common shares, intrinsic value, orders, index weighting, price return index, industry life-cycle stages, growth rate, forms of market efficiency, Porter’s five forces, Gordon model

7. Fixed Income

This section discusses fixed income markets and instruments, as well as the methods used to price them. A number of important concepts are discussed, including yield measures, convexity and duration. This section begins with a bond analysis and valuation, then goes on to the bond’s features, and lastly to ten risks related to debt investments. This section has a 10% weightage on the exam.

Your goal: Learn about the mechanisms that underlie fixed-income instruments. It was more difficult than you could have imagined.

Key terms: basis point, callable bond, forward rates, convexity, modified duration, matrix pricing, yield-to-maturity, effective duration, accrued interest, spot rates, interest rate risk, 4 Cs of credit analysis

8. Derivative Investments

Derivatives are complicated financial instruments, and this section focuses on them, covering the fundamentals of futures options, forwards, swaps, and the most common hedging techniques. Furthermore, while researching these exotic financial instruments, more advanced mathematical techniques are frequently used. Even yet, in Level I, the majority of the content is introductory, and this portion is just 5% weightage, with only roughly 12 questions in the exam coming from it.

Your goal: Learn about derivatives and how they function. If you want to trade them, you’ll need to be sure you know everything there is to know about the subject.

Key terms: payoff formula, arbitrage, option value, put option, marking-to-market, moneyness, cash settlement, offsetting, put-call parity, FRAs, margin call, call option, American option, collar, protective put

9. Alternative Investments

This section covers investment forms that aren’t addressed in the other CFA knowledge areas. It includes venture capital, real estate funds, hedge funds, and commodities. Because there will be a strong emphasis on commodities, it will be essential for participants to have a thorough understanding of commodity trading concepts. This section may have seven or eight conceptually focused questions, some of which are directly connected to commodities. Despite the fact that this component of CFA Level I has a low weightage, with reasonable effort, these portions might be mastered with relative ease.

Your goal: Learn non-standard features of alternative investments that set them apart from bonds, stocks, or cash.

Key terms: low liquidity, survivorship bias, management fee, high water mark, downside risk measures, hurdle rate, backfill bias, LBO, MBO, incentive fee, exit strategies, REITs, diversification

10. Portfolio Management

This section deals with fundamental principles of portfolio management and introduces some key concepts, including the Theory of Modern Portfolio and Capital Asset Pricing Model. Section weightage is only 7% which roughly translates to about 17 questions in the exam. However, this section gains increasing significance in Level II and Level III of CFA as the focus shifts to applying available knowledge for efficient portfolio management.

Your goal: All about the portfolio, including its structure and diversification, risks, and returns. Especially important if you plan to become a portfolio manager.

Key terms: risk aversion, risk & return trade-off, diversification, modern portfolio theory, utility function, fintech, efficient frontier, correlation coefficient, beta, CAPM, CML, CAL, SML, Investment Policy Statement

FAQs – CFA Level 1 subjects

What is the format of Level I of the CFA exam?

The exam consists of 180 multiple-choice questions and is computer-based. There are two sessions, each lasting 2 hours and 15 minutes.

Is there a break between Session 1 and Session 2 of the CFA Level 1 exam?

Between Session 1 and Session 2, there is an optional 30-minute break.

What are the 10 subjects in CFA Level 1?

- Ethical and Professional Standards

- Quantitative Methods

- Economics

- Financial and Reporting Analysis*

- Corporate Finance*

- Equity Investments

- Fixed Income

- Derivative Investments

- Alternative Investments

- Portfolio Management

How much study time do I need for the Level I exam?

The average successful candidate spent 303 hours preparing for the Level I exam held in June 2019, according to CFA Institute.

If I do not pass the CFA Level I Exam, how long do I have to wait before I can retake it?

Beginning in 2022, every candidate who does not pass their exam will have to wait at least six months to retake it.

The CFA exam is designed to be challenging as a whole. It’s a prestigious designation that indicates true experience in the field of investment management. Continue to understand why the CFA Program is the most prestigious and well-known investment management designation in the world.

How is Level I of the exam graded?

The grading of CFA exams is done by machines and charterholders. The CFA Institute then applies a method to each exam to calculate a minimum passing score. All of the specifics may be found in our article on how the CFA exam is evaluated at all levels.

Are 6 months enough for CFA Level 1?

The level 1 CFA test can be studied for in just six months. You can easily prepare for 400 hours of studying in 6 months while prepping for your exam.

There is a ton of information to take in! However, before starting your CFA program, you should be aware of these things. The CFA Level 1 test is evenly distributed and covers a variety of subjects. Some CFA Level I subjects could require more study time than others, but the most important thing is to develop and stick to a study plan.

PCCN vs CCRN: Which Certification Should I Take?

In this discussion, we will examine the fundamental distinctions between PCCN vs CCRN certifications, allowing you to make an informed and right decision about which certification is best for your nursing career progression.

June 20, 2023

Is PCCN Worth It? A Comprehensive 2024 Study Guide

In this article, we will provide all the enrollment criteria, how to apply, whether is PCCN worth it for you to obtain, and how to get a high mark.

June 20, 2023

PCCN Requirements - How to Become a Progressive Care Certified Nurse?

To become a progressive care nurse, you must first obtain the PCCN certification. This post will help you understand PCCN certification, PCCN requirements, and efficient approaches to obtaining this certification.

June 20, 2023