Fun & effective Series 7 practice test tool to pass with flying colors

All-in-one platform with everything you need to ace the Series 7 on your first attempt

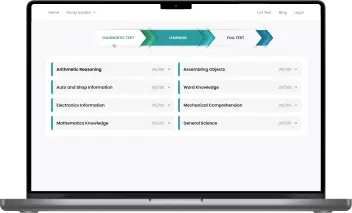

Clear and Thorough Learning Path

Proven SERIES 7 3-step Practice Formula

After our 100,000+ users' success stories, we developed a 3-step strategy to provide you with the most precise and in-depth learning path while minimizing your prep time.Series 7 Diagnostic Test

First, take this short test and get your detailed report showing your strong and weak areas. Save your time by concentrating on what is in demand.Learning

With quick, bite-sized learning techniques and a detailed study guide for each Series 7 section, you can really strengthen your weaknesses (from step 1) and boost your scores.Series 7 Full Test

The last step for your preparation is taking our full Series 7 practice tests and seeing how far you've come since the beginning. Repeat the 3-step formula until you are satisfied with your results!Ready to start?

Thousands of Series 7 users already accomplished their goals.NOW it’s your turn!

What You Get

All-in-one platform

A complete Series 7 Prep Platform, including a diagnostic test, detailed study guides for all topics, practice questions with step-by-step explanations, and various full simulator tests.

Questions nearly identical to those in the real Series 7 test

All questions are categorized into the specific sections as on the real Series 7: Same format & same difficulty!

Best for the busy

Easily & quickly grasp all the knowledge with our unique learning technique. And you can learn anytime, anywhere on any devices, even with a few free minutes.

Practice while having fun

Learn and play! Complete round-by-round to reach your daily achievement and make progress on your learning journey!Featured on

What our users are saying

Over 50,000 aspiring American candidates use Series 7 monthlyYou may enter the larger financial services sector on a professional level by passing the Series 7 General Securities Representative Exam. All financial securities instruments, including stocks, bonds, exchange-traded funds (which are often known as ETFs), and municipal securities, are eligible for solicitation, purchase, or sale by candidates who pass this test. Anyone seeking a career in financial services should consider passing the Series 7 test a major accomplishment.

It will require time and effort to pass the difficult test. Thankfully, applicants are not forced to work alone. You will have a thorough grasp of the Series 7 exam and the best methods of preparation after reading this blog article.

What is the Series 7 Exam?

The Series 7 exam is a licensing exam, established by the Financial Industry Regulatory Authority (which is also known as FINRA), for stockbrokers and other financial services specialists who are involved in the trading of investments (such as bonds and stocks), but not commodities or futures. This exam is required in order to obtain a license to trade securities. To give it its proper name, this test is called the General Securities Representative Examination (or GSRE for short).

The candidate's knowledge of the activities that are required of a broker, such as the sale of corporate securities, investment group products, government securities, options, variable annuities, packaged securities, directly proposed framework, and municipal securities, will be evaluated during the exam. The examination guarantees that individuals working in finance have a solid understanding of the financial sector and are capable of directing others toward choices that will not disturb the national economy.

The Series 7 examination is by far the most time-consuming and difficult of all securities examinations. Candidates are given three hours and 45 minutes to respond to questions that test their knowledge of a wide variety of topics related to securities and financial regulation.

It is a requirement for becoming an officially registered representative of the Financial Industry Regulatory Authority, which not only boosts a professional's employability in the financial services sector but also makes them eligible for higher-level positions. The Series 7 test does not include any material related to insurance products or real estate properties. To be licensed to market real estate and insurance goods, brokers need to pass further tests.

In addition to being prepared with business knowledge, finance practitioners who pass the Series 7 test are obliged to adhere to tougher criteria than unregistered brokers. To provide the finest level of service to its customers, FINRA-licensed brokers are required to meet the industry's strictest standards.

Series 7 Exam Requirements

Candidates are required to have passed the Securities Industry Essentials (SIE) test, which was first administered by FINRA on October 1, 2018, before they are eligible to take the Series 7 exam. Entry-level brokers are required to take the SIE, which is an introductory test. It examines key themes such as product knowledge and principles of stock trading, as well as government regulators and how they operate, acceptable and unacceptable practices, and understanding of acceptable and unacceptable industry practices. Candidates for the SIE test do not need to have a sponsorship from a FINRA member company to take the exam.

Candidates for the Series 7 test are required by FINRA to have a member company sponsor them to meet one of the conditions for taking the exam. In order for a candidate to be registered for the Series 7 test, the sponsoring business is required to submit Form U4, also known as the Uniform Application for Security Industry Registration.

The Series 7 examination fee is another expense that must be covered by the sponsoring company. To get a license to trade securities, applicants are required to first meet the requirements of both the Series 7 test and the Securities Industry Essentials exam (SIE). As long as they do so within the allotted time frame, prospective candidates are expected to pass both examinations, regardless of the sequence in which they choose to take them.

Series 7 Exam Structure

Candidates are given 125 multiple-choice questions to answer during the Series 7 examination, which must be finished within three hours and forty-five minutes. This indicates that the candidate will have 1 minute and 48 seconds to respond to each question. Test-takers are required to get a score of 72% or above on the examination in order to be awarded a license to engage in clinical practice. The prior exam price of $305 has been reduced to $245, therefore the total cost of the test is now $245. The exam structure is mentioned in more detail here:

Seeks Business for the Broker-Dealer From Current and New Customers (7%)

The majority of this function's responsibilities include public communication as well as the control of advertising materials. Investment salespeople, such as stockbrokers and securities dealers, will find the rules and regulations that are being challenged in this area to be of special interest.

Opens Accounts After Obtaining and Evaluating Customers’ Financial Profile and Investment Objectives (9%)

The second function addresses how to deliver information to clients about different sorts of accounts and the disclosures and limits that go along with them. Candidates have to show that they have an understanding of the information necessary to establish brokerage and advisory accounts, build and manage client profiles, and get relevant permissions.

Provides Customers with Information About Investments, Makes Recommendations, Transfers Assets, and Maintains Appropriate Records (73%)

On the Series 7 exam, this is the portion with the most questions and the highest weight. Function 3 addresses a broad variety of securities laws and industry rules relating to investment strategies, product alternatives, record keeping, and client profiles. These regulations and statutes include a diverse range of subjects.

Obtains and Verifies Customers’ Purchase and Sales Instructions and Agreements; Processes, Completes and Confirms Transactions (11%)

This duty is largely concerned with ensuring that Registered Representatives are knowledgeable of the execution and processing of client orders and trades, as well as the regulatory standards for transaction resolutions, client complaints, margin, and documentation and record-keeping.

Before the first of October 2018, applicants were needed to finish all 250 questions within 6 hours, and the cost of the test was $305 in total. Because there was no SIE test, all that was needed of candidates was that they complete the Series 7 exam. Since the new structure for the Series 7 exam was implemented, the examination has become both more concise and more reasonably priced. In addition, to become licensed brokers, applicants need to pass both the SIE and Series 7 tests.

After successful completion of the Series 7 test, the Financial Industry Regulatory Authority (FINRA) does not provide applicants with tangible certificates. Instead, prospective employers may view the evidence of successful completion of the test on FINRA's Central Registration Depository (CRD). The Series 7 test is a requirement for several other securities examinations, including the Series 24, Series 26, and the Series 31 exam.

Is the Series 7 Exam Hard?

The Series 7 test is often regarded as the most challenging of all the securities license examinations because it consists of 125 questions that must be solved within three hours and 45 minutes. The required minimum score to pass is 72, which may not seem like a very high bar to reach.

However, the examination will cover a wide range of topics, including all of the different types of securities products and the regulations that regulate client accounts. The questions, which are often rather long and include a great deal of material, are intended to test a candidate's knowledge of a topic. This is one reason why practice examinations are of such critical significance.

The majority of students believe that the Series 7 exam is more challenging than the SIE. This might be because the Series 7 offers a substantially wider variety of customization possibilities. A further distinction between the SIE and the product questions is that the product questions are more application- and suitability-based, while the SIE is more concerned with the definitional treatment of goods.

It is advised that candidates learn via a range of ways, such as reading, listening, and watching, as well as continual testing, which is the most important component of the process.

What Is the Pass Rate of the Series 7 Exam?

While FINRA doesn't publicize a pass percentage for the Series 7 tests, it is usually thought to be approximately 65%.

In any case, the passing rates that are reported by test prep services are the most dependable indications of overall success rates. All of the service providers have a pass rate of at least 85% or, if none of their pass rates are available, they promise your money back.

On average, those who failed the exam the first time around do much better the next time they take it. If you do not pass the exam on your first try, you will have the opportunity to repeat it after a period of one month. The 30-day wait requirement also applies if you fail on the second try. Once you fail once more on your 3rd attempt, you will be required to wait 180 days to take the test.

Series 7 Exam Cost

Exam Costs

Because of its stringent regulations, the Series 7 exam may only be taken at authorized testing facilities. A minimum price of $265 is required to sit for the examination, although the charge may be somewhat higher in various geographic regions. Although a total score of 67% is considered to be the national testing average for the Series 7 exam, a passing grade requires a score of at least 70% in order to be awarded. If a person takes the exam more than once and still does not pass, they will be required to pay an extra registration fee of $200 for each attempt they make to retake it.

Registration and Renewal

Following successful completion of the examination, the applicant will be eligible to get a Series 7 General Securities License. Additionally, license application and renewal costs ranging from $50 to $450 may be required, depending on the state. In the event that the license is allowed to lapse as a result of inactivity, the applicant will be asked to retake the exam and pay any costs that are related to it.

Additional Testing Fees

- Background Check and Fingerprinting

The entire cost of the mandatory fingerprints and background check, which must be completed in advance of the Series 7 exam, may be included in the price of taking the exam. However, there are circumstances in which extra expenses, beginning at around $30, will be incurred for the mandatory background check and fingerprints.

- Resources for Learning

A large portion of the cost of earning a Series 7 license often goes into exam preparation. A student can improve their chances of doing well on a test by enrolling in an approved exam preparation course; however, the tuition for such a course may range anywhere from $900 to more than $3,000. Some applicants choose the less expensive alternative of self-study by buying books or online material. The cost of these resources may vary from 50$ for a set of flashcards up to 300 $ for an entire course text.

- Sponsorship

To get a Series 7 license, you will first need to obtain sponsorship from a recognized broker business. If a person is not already employed by a registered brokerage, they may look for sponsorship from an outside source; nevertheless, the vast majority of firms will normally sponsor their workers. Certain businesses would provide applicants sponsorship in exchange for a predetermined payment that may range anywhere from $300 to $2,000 or even more.

How Many Times Can You Take the Series 7 Exam?

After a waiting period of 30 days, FINRA will let a candidate retake the Series 7 examination if they did not pass it on their first try. There is no cap on the number of times a person may try to pass the test; however, applicants who have already taken the examination many times are subject to time limits on subsequent attempts.

A minimum of one month must pass between each of an applicant's first three tries at taking a test before that candidate may take it again. If a candidate does not pass the examination during any of their first three tries, they will need to wait at least 6 months before trying again.

How to Get a Series 7 License?

Those working in professional fields who possess a Series 7 license can enhance their careers and may be eligible for better-paying jobs. Take the following steps to acquire your Series 7 license:

- Get a college degree

To be employed in the financial sector as a stockbroker or other kind of financial counselor, you need to have a minimum of a 4-year formal education. The majority of professionals working in the financial sector have a bachelor's degree, often in a field related to business, statistics, finance, or banking. Even though it is not needed, some stockbrokers and other business professionals choose to get a master's degree. This might potentially increase their earning potential as well as their work opportunities.

- Get your SIE certification

The Securities Sector Essentials (SIE) exam is a test for aspiring professionals in the financial industry that serves as an entry-level qualification. According to FINRA, the Securities Industry Essentials Exam (SIE) and the Series 7 Exam are both required to get a license, however, you have the freedom to choose the sequence in which you take the exams. The SIE test is often where professionals get their start since it needs fewer requirements than other exams.

In addition, it is possible to take the SIE examination before being sponsored; hence, it is possible to take the SIE examination while simultaneously pursuing a bachelor's degree. Since the results of the SIE are valid for four years, you should give serious consideration to taking the exam in the third or fourth year of your bachelor's degree.

- Find a job or internship

You need to have a sponsorship from either a member organization of the Financial Industry Regulatory Authority (FINRA) or a self-regulatory body in order to be qualified to sit the Series 7 Exam (SRO). To be eligible for this sponsorship, you will need to get employment or an internship with a finance company, such as a bank or brokerage company.

Look on the firm's website for any reference of series 7 sponsorships while you are searching for a job with the company. In most cases, sponsorship possibilities are advertised by the company since it is aware that entry-level professionals are required to pass this test. Once you've found a job, the next step is to inquire with your company about taking the Series 7 Exam under their sponsorship. The firm will often submit your application for you and will frequently cover the cost of your test registration.

- Study and prepare for the Series 7 Exam

If you are not well prepared, the Series 7 Exam might be difficult. There are a total of 135 questions, however, only 125 of them will be assessed. The Series 7 Exam covers material that is associated with the primary responsibilities of a stockbroker. These functions consist of the following:

- Investigating the possibility of new clients for the brokerage company.

- Establishing new accounts for customers

- Performing an analysis of the customer's financial profile

- Offering clients information on investments and providing appropriate recommendations

- Transferring assets

- Maintaining precise records is essential.

- Authenticating financial dealings

You may want to think about putting together a study group or schedule dedicated study time. This may assist you in developing effective study habits. Classes for studying for examinations and going over material previously covered may be a very useful resource. Studying for the Series 7 Exam in a way that is both efficient and effective will provide you with more confidence to pass the exam.

- Pass the Series 7 Exam

You need to get a score that is at least 72% higher than the passing grade to pass the Series 7 Exam. There are situations when the score you receive might determine the career opportunities available to you.

If you pass the test, you will be able to join the financial business at a more advanced professional level than others who have not passed the exam. On the other hand, those professionals who have a better score on the Series 7 Exam may have an edge in the employment market.

Our Series 7 Practice Test - GSRE Exam Features

Free Practice Questions: 1000+ FREE Series 7 Exam - GSRE practice questions with detailed explanations are available for all of the required skills. All you need to pass your recruitment test is available here.

- Series 7 Exam - GSRE Practice Tests Based On Real Tests: Same number of questions, same time limits, same structure. The exam simulators let you familiarize yourself with the test format and get ready for the real one.

- No Sign-Up Or Login Required: All of your progress is saved without an account, even if you close your browser. But login can sync your data between web and mobile applications.

- Gamification: The learning process will be divided into small milestones. Let’s make your studying exciting as if you were in some interesting games.

- Personal Study Plan: Just enter your Series 7 Exam - GSRE test date and a study plan will be set up for you. A clear schedule will surely exceed your expectations and get you the best preparation for the reading shot.

- 3 Interesting Test Modes: 3 different test modes with increased difficulty levels let you experience the test in various ways.

- Dark Mode: Experience a dark theme that is more friendly to your eyes, and get a whole new and marvelous experience.

- No Internet Required: Study on the go conveniently without any Internet connection.

- Series 7 Exam - GSRE Test Bank: 3 features: Weak/ Medium/ Strong questions help you determine which area you should pay more attention to.

FAQs About Series 7 Exam

How long does it take to study for the Series 7 Exam?

The amount of time necessary to prepare for the Series 7 test is very variable from person to person and is mostly determined by the person's time investment and learning styles. A person who is new to the field of finance may find it challenging to understand the subject, depending on the individual's prior knowledge and experience. The majority of service providers suggest a period of eighty to one hundred hours.

How do I register for the Series 7 Exam?

The process of registering for the Series 7 test requires coordination between the applicant and the FINRA member company that is sponsoring them. The first thing that has to be done is to open what FINRA refers to as an "enrollment window." Once the enrollment period of 120 days has begun, a candidate or their sponsor may contact Prometric in order to arrange an examination.

It is advised that you plan your exam for a considerable amount of time in advance since each Prometric testing location can only administer a specific number of examinations each day. This will guarantee that you obtain the day and time of your choice, in addition to the place of your choice.

Why is it necessary to pass the Series 7 Exam?

To work as a stockbroker in the United States, one must first get a Series 7 license, which is often regarded as the most prestigious certification available to financial advisors.

Which test, the Series 7 or the CPA, is harder?

The Series 7 examination includes municipal fund securities, corporate securities, soliciting, and a variety of other topics. It has around a 65% success rate overall. In comparison, the topics that are tested on the CPA exam include business principles, financial reporting and reporting, legislation, and inspection and verification. Both assessments are comprehensive and challenging.

How many times can I fail the Series 7 Exam?

You do not need to have any particular education to take the Series 7 Exam, and the organization has not imposed any restrictions on the number of times you may try to pass the exam.

Is there a lot of math on the Series 7 Exam?

You should prepare for the test to consist of roughly 10–15 percent math, including questions on margin and choices. It is important to keep in mind that there are many alternative ways to get a passing score; hence, you do not necessarily need to do exceptionally well on the mathematics problems to pass the test as long as you make up for it in other areas (e.g., suitability questions).

Does the Series 7 license expire?

Following the expiration of your subscription, your Series 7 license will remain active for an additional year. If you do not obtain work within those two years with a financial business that is either a member of FINRA or an SRO, then your Series 7 license will expire. If you find work within the allotted time frame of two years, the new company will be responsible for notifying FINRA on your behalf.

Above is all the necessary information about the Series 7 Exam. Remember that the Series 7 Exam is such an essential part of the process of getting the Series 7 license, but it is not the only part. Read this article to be well-prepared for your process of getting Series 7.