Two key considerations—improving your job chances and increasing your income—frequently play a significant role in determining whether or not to seek a professional degree or certificate. There is broad consensus that, beyond a certain point in one’s career, the work profile and position matter more than the pay. This is true to some extent, but in any job sector, money is still an important consideration. One of the most prominent programs in the financial sector is the Chartered Financial Analyst (CFA) program.

Let’s look at the many variables that affect CFA salary, which is determined by a variety of criteria, including educational requirements, experience, geographic location, type of employer, and position in the organization. Because income is such a pivotal consideration in deciding whether to become a CFA, there are many factors that influence CFA salary. For instance, CFA charterholders who work for large organizations frequently make more money than those who work for startups.

Take our free CFA Level 1 practice test now to pass the test and land well-paid job.

What does a CFA charterholder do?

Financial analysts keep a close eye on the state of the economy. They assist clients by advising them when to purchase and sell investments. They keep up with economic trends, critical business news, as well as company and industry strategy. CFA chartholders make reports that explain their analysis, share their knowledge with non-financial specialists, and occasionally share their findings with the general public and financial media.

Securities, commodity contracts, and other financial investing enterprises are the major employers of financial analysts, according to the Bureau of Labor Statistics. Financial analysts, however, can work in a variety of fields, including professional services, insurance, and management.

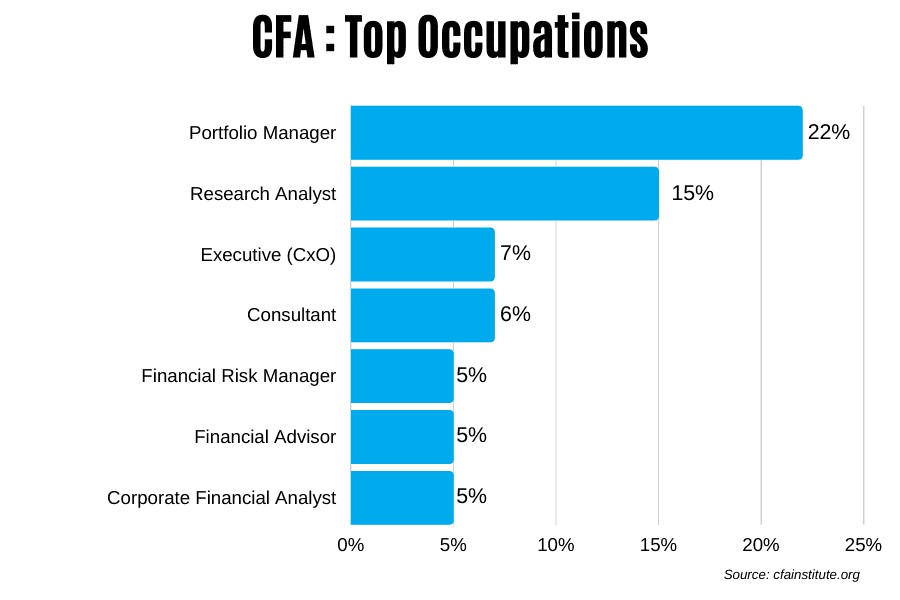

Earning a CFA charter allows you to pursue a variety of employment opportunities in the financial industry. The most prevalent job functions are listed below.

22% of CFA charterholders are employed to work as portfolio managers, according to CFA Institute. A portfolio manager is in charge of a fund or a group of funds. They collaborate with researchers, analysts, and clients to keep up with market trends and important business news. As the markets fluctuate, portfolio managers make decisions to purchase and sell assets throughout the day.

15% of global CFA charterholders indicated they worked as research analysts, studying mathematical procedures and qualitative data to assess what had previously occurred and create predictions for the future.

7% of all CFA charterholders have proceeded to the executive level. Executives with CFA charters are the chief financial officer (CFO), investment officer (COO), or chief executive officer (CEO).

6% of CFA charterholders are consultants. Firms hire consultants to give independent expert perspectives on business valuation, provide economic analysis and forecasts, and identify opportunities to increase shareholder value.

5% of CFA charterholders are financial risk managers. Financial risk managers identify and assess potential risks that a business is currently facing and might face in the future.

5% of all CFA charterholders are financial advisers. Financial advisers assist customers in setting long- and short-term financial objectives, as well as making decisions about tax laws, investments, and insurance product selection.

5% of CFA charterholders are corporate financial analysts. Corporate financial analysts are in charge of conducting research and providing advice considering macroeconomics and microeconomics concerning corporate investment decisions.

Is the CFA charter worth it?

Getting a CFA certificate may be a difficult process, but the CFA benefits you will receive at the end will make it all worthwhile. The CFA designation is a prestigious degree that increases your financial professional worth and credibility, as well as your upward mobility.

With top financial businesses, you’ll have a better chance of landing a job. While not all investment professionals or financial advisors are CFA charterholders, it is one of the highest standards that a financial professional can meet. The CFA designation is required by many major firms for senior positions in Investment Management and Securities Research. Top financial services businesses have recently begun to recognize the CFA designation as a ticket to an increasing number of financial advisory positions and career paths.

Progression in your career and salary. Risk manager, portfolio manager, and research analyst are several of the investment-related jobs that you may get with the CFA charter. 7% of CFA charterholders even progress to the position of chief executive officer. The CFA designation raises salaries by about 15% to 20% on average.

The CFA Charter is recognized worldwide, by universities, companies, and certification programs in at least 30 countries.

CFA Salary – How much does a CFA make?

Earning your CFA charter helps you develop well for your career as a finance professional. But how much money can you make? CFA charterholder salaries in the United States range from $64,234 to $255,000 per year, according to Payscale. There is such a big range since the charter may be used in a variety of positions with varying levels of responsibility. Years of experience and bonuses also make a difference. So, let’s take a look at what the chartered financial analyst salary is.

Portfolio Manager Salary

According to the CFA Society Chicago’s annual financial compensation study, a fixed income portfolio manager’s median base annual salary is $132,500, while an equities portfolio manager’s median base annual salary is $136,000.

Research Analyst Salary

CFA charterholders who work as research analysts earn an average of $73,954 per year, according to Payscale.

Chief-Level Executive Salary

According to the CFA Society Chicago, with CFA charters chief investment officers earn a median annual base pay of $227,500, while CFOs earn $170,618 said Payscale.

Consultant Salary

According to the CFA Society Chicago, the median base annual salary of CFA charterholders who work as consultants is $74,000.

Risk Manager Salary

CFA charterholders who work as risk managers earn a median yearly base pay of $126,060, according to the CFA Society Chicago.

Relationship Manager Salary

Relationship managers earn an average of $120,000 per year

Financial Advisor Salary

Financial advisors have an average base income of $110,000.

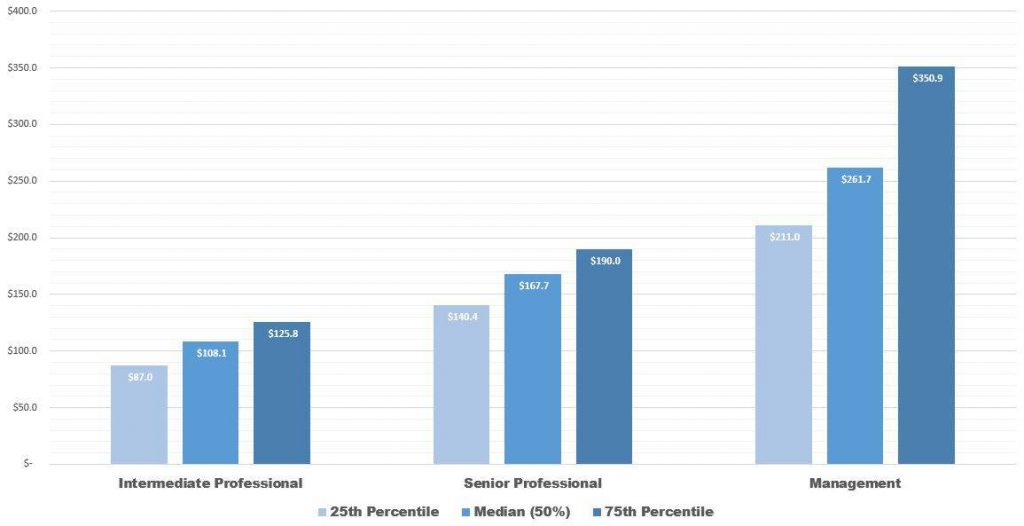

The figure below shows the CFA average salary and total compensation (salary + incentive) for portfolio managers having a CFA designation.

According to data from CFA Institute Compensation Survey.

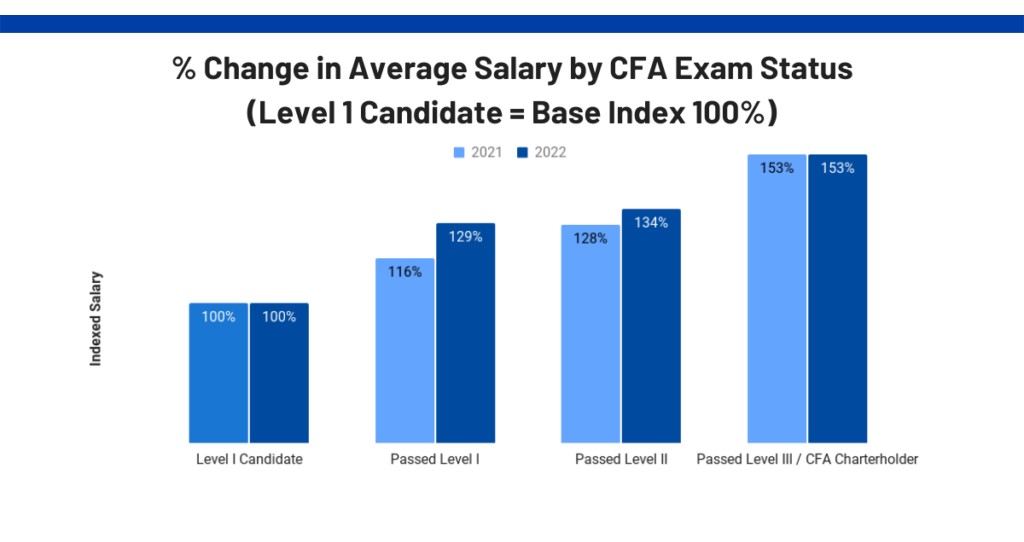

Candidates’ work experience tends to increase as they progress through the CFA program. A CFA Charter, according to the research, improves average earnings by 53%. Even when the job experience factor is removed, the average pay increases as candidates progress through the CFA Program.

The CFA level 3 salary is on average 53% more than the CFA level 1 salary, according to submissions.

Candidates who passed CFA Level 1 had a 29% increase in salary in 2022, while CFA Level 2 salary increased by 34%.

In contrast to 2022, there is a significant change this year, accordingly CFA level 1 salary on average increased significantly higher at 29% (vs 16&), whereas the CFA level 2 salary increases by 34% compared to a Level 1.

As a result, it seems that the employment market has changed, with passing CFA Level 1 and Level 2 valued similarly in terms of average salary rise.

This might be great news for individuals who pass CFA Level 1 because the payback would be earlier and faster.

That said, if you want to optimize the “CFA effect” on your pay, you should try to pass CFA Level 3, as the CFA level 3 salary on average increased by 53% last year.

Therefore, that’s some motivation for you to complete all 3 CFA exams!

Are CFAs in demand?

The future prospects for chartered financial analyst charterholders are promising. For the foreseeable future, financial analysts are projected to be in high demand.

A rising range of complicated financial products and the requirement for an in-depth understanding of sectors in numerous geographic regions are expected to spur considerable job development. This growth in jobs will be aided by the global diversification of investments and the rising complexity of investments. Financial analyst employment is expected to grow 11 percent by 2026, faster than the average for all occupations, according to the Bureau of Labor Statistics.

An equity research career is very demanding, with analysts and associates frequently working 70+ hour weeks. Competition for vacancies is strong. Compensation, on the other hand, is substantial. Equity research has fewer prospects for development than other divisions, with seniority determined by the quality of research.

Investment banking is a hugely demanding profession, with analysts frequently working 100-hour weeks. The competition for vacancies is intense, the work is high-profile and the compensation is high.

What are the requirements for CFA designation?

Candidates for the CFA designation must meet at least one of the following requirements:

- Have a bachelor’s degree (or an equivalent degree) or be in your last year of a bachelor’s program.

- Have accumulated 4000 hours (if you work full-time, it will take about two years) of relevant professional work experience (not required to be related to investments).

- Have a passport that allows you to travel internationally. At the exam location, it is the only kind of identification that is accepted.

- Be enrolled in the CFA Program.

- Be a resident of a country that is not on the list of Specially Designated Nationals.

- Pass the CFA exam on all three levels.

How to increase your CFA Salary?

The key to increasing your CFA salary as a charterholder is to make yourself more valued, including strategies such as taking on a cross-functional role, asking for more responsibility, upgrading your technical financial skills, mentoring junior team members, and becoming a lynchpin and an indispensable member of the team.

Furthermore, knowing the current salary market for your skill level and job function is always beneficial. If you believe you are underpaid, or if you have a talent that increases your earning potential, don’t be hesitant to ask for a raise at performance reviews. The goal is to demonstrate your worth via your work and to conduct thorough research on the appropriate level of compensation for your knowledge and skillset.

FAQs – CFA Salary

How much money does a CFA make?

CFA charterholders with 0 to 5 years of experience can earn anywhere from $50,000 and $253,000 per year. Those with less experience get less pay, while those with two to four years of experience earn more.

How much does a CFA increase your salary?

The CFA designation raises wages by about 15% to 20% on average. It indicates that the CFA qualification leads to a higher income increase in senior jobs than in entry-level employment.

Who earns more CPA or CFA?

The average CPA earns 7.5% less than the average CFA charterholder as a result of this. When you examine the experience levels of the CFA and CPA samples, you’ll see that the average CFA charterholder has more experience than the average CPA, according to our findings.

Is CFA Level 1 enough to get a job?

Yes, you certainly can. Internships and job experiences in the investing industry are also recommended. This is critical, and I don’t see any issues with a CFA level 1 and solid interviewing abilities.

Is CFA prestigious?

The most prestigious designation in finance and investing is CFA. First and foremost, you are already aware of the reputation of the CFA Institute (CFAI) and its charterholders if your goal is to invest professionally.

The best approach to assess how much your CFA salary will increase and whether a CFA charter will advance your career is to seek advice from colleagues and mentors and examine compensation data for your target profession. A key step in developing a successful career path is understanding the requirements for achieving your target job or degree of seniority and then deciding which traits and professional qualifications will help you get there faster. We trust that this post has clarified your concerns and assisted you in selecting the best career path.

PCCN vs CCRN: Which Certification Should I Take?

In this discussion, we will examine the fundamental distinctions between PCCN vs CCRN certifications, allowing you to make an informed and right decision about which certification is best for your nursing career progression.

June 20, 2023

Is PCCN Worth It? A Comprehensive 2025 Study Guide

In this article, we will provide all the enrollment criteria, how to apply, whether is PCCN worth it for you to obtain, and how to get a high mark.

June 20, 2023

PCCN Requirements - How to Become a Progressive Care Certified Nurse?

To become a progressive care nurse, you must first obtain the PCCN certification. This post will help you understand PCCN certification, PCCN requirements, and efficient approaches to obtaining this certification.

June 20, 2023